Rapido's David vs Goliaths

Jun 15, 2024India’s bustling ride-hailing industry has long been dominated by two major players: Ola and Uber.

Between 2014 and 2018, this duopoly faced minimal competition, with players like Taxi For Sure, Meru Cabs, and EasyCabs relegated to the periphery. However, the landscape was about to shift with the arrival of an unexpected contender.

Disrupting the Duopoly

While Uber and Ola were focused on expanding their cab and auto-hailing services and vying for market share, Rapido turned its attention to a niche market that was previously underserved. Instead of competing head-to-head in the crowded ride-hailing space, Rapido concentrated on bike taxis. By harnessing the agility of bikes, Rapido offered a faster and more cost-effective option for short-distance travel.

Though bike taxis were not a novel concept—Grab and GoJek had already established dominance in Southeast Asia—Rapido was the first to effectively adapt this model to the Indian market.

Rapido’s growth trajectory has been impressive, expanding its services to over 100 cities across India. The company’s ability to penetrate Tier 2 and Tier 3 cities, where public transportation infrastructure is often inadequate, has been a significant factor in its widespread adoption.

Rapido’s entry into Auto and Cab market

By 2020, Rapido had established itself as the leading bike taxi provider in India. Building on this success, Rapido ventured into the auto-taxi market in 2020 and the cab-taxi market in 2023. This expansion was strategically sound, as revenue from cabs and autos is generally higher than that from bike taxis. Additionally, with incumbents like Ola and Uber launching their own bike-taxi services, Rapido faced increased competition in its original market segment.

It was finally time for Rapido to challenge the incumbents head-on. However, Rapido recognized that directly competing with Ola and Uber would be a formidable task. Instead, the company opted for a differentiated business model and an innovative product strategy to carve out its niche and effectively compete.

Differentiated Business Model

Focus on drivers, customers would come

Before discussing about Rapido’s differentiated business model, it is important to look at the customer’s Jobs To Be Done (JTBD).

Customers want:

- Safe rides at an economical cost.

- Less waiting time when booking the ride.

In the beginning, Uber and Ola as market creators had to focus on providing rides at an economical cost to drive up adoption. They did this via massive marketing push and more importantly by heavily subsidising the rides.

However, now that the customers have become habituated with ride hailing, low cost can no longer be the value proposition. Majority of the customers are ready to pay slightly more for a ride if the waiting time for booking is less.

Another major issue that customers widely mention about Uber and Ola drivers is their propensity to cancel rides after accepting the booking.

Rapido realized that Uber and Ola were focusing on the wrong value proposition, and this insight guided their unique approach to the market. Instead of subsidizing rides for customers, Rapido focused on attracting more riders to their platform. Their business model was designed to incentivize riders from Ola and Uber to switch to Rapido.

While the incumbents had a commission based model, Rapido followed the Subscription model.

Instead of levying a commission on drivers using its platform, Rapido charged a login fee: Rs 5 for autos and Rs 29 for cabs. Drivers on the Rapido platform need to pay a subscription fee of Rs 500 if their monthly earnings exceed Rs 10,000.

Rapido’s subscription model incentivizes drivers to work for Rapido without worrying about Uber or Ola taking a significant cut of their earnings. Additionally, when drivers pay a daily login fee, they are psychologically tied to driving for Rapido, similar to how Amazon Prime customers feel committed to using Amazon’s services.

By attracting more drivers to the platform, Rapido is able to significantly reduce the booking time for customers compared to other platforms. This shorter booking time prompts more customers to switch to Rapido, resulting in more rides for drivers and higher revenue-earning potential. The higher earning potential attracts more drivers to the platform, thereby creating a virtuous cycle.

Innovative Product Strategy

Rapido’s Product Strategy is closely aligned to their business strategy. Due to their unique business model, their app has features that are currently not present in its competitors.

Rapido suggests a price but allows the customer to adjust it as they see fit. Drivers can then choose to accept or decline the ride based on the customer’s set price. This creates a simplified free market where the service provider and customer negotiate a suitable price.

If the customer is in a rush, he can choose to set a higher price, thereby incentivizing the driver to accept the ride.

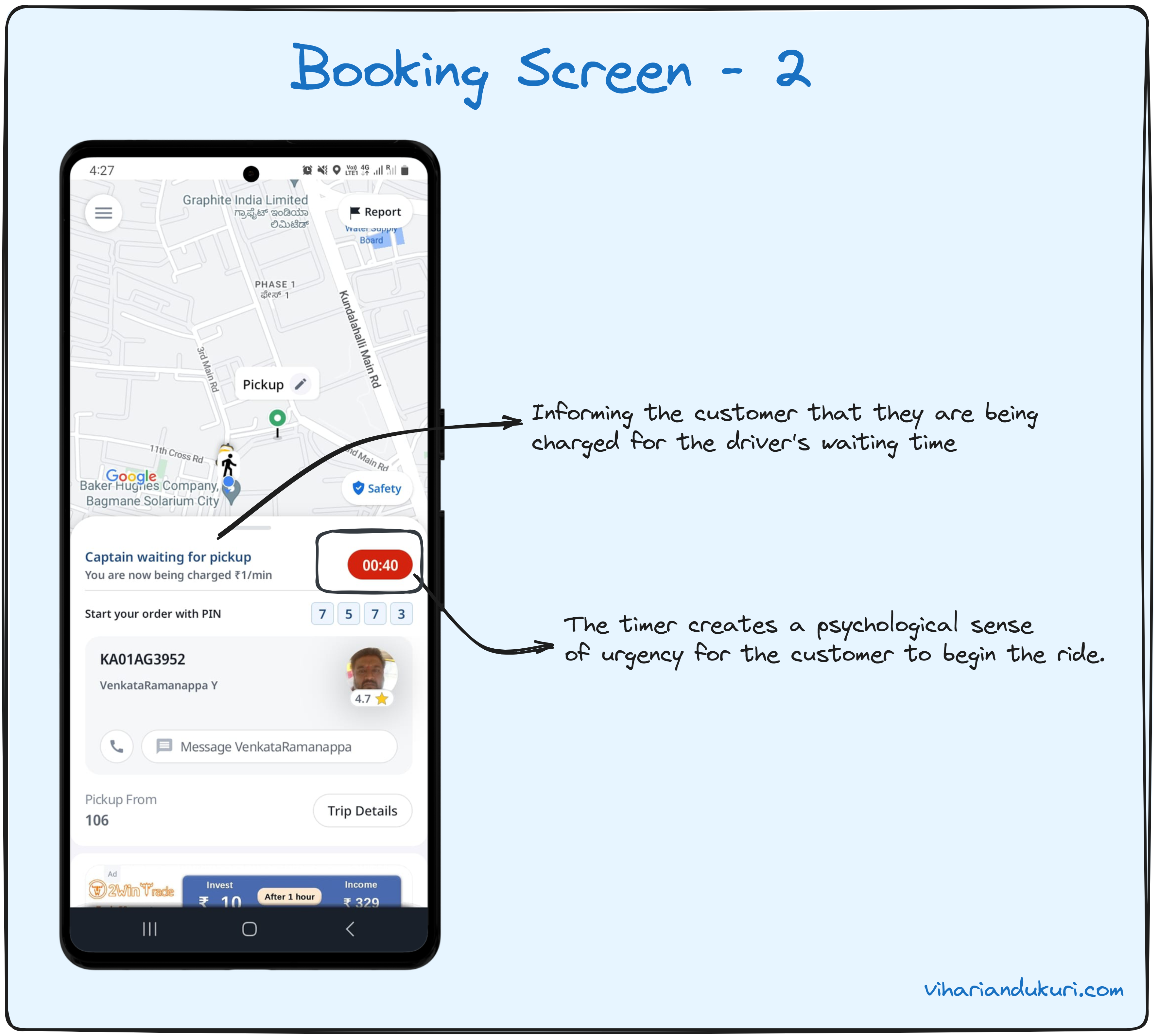

Another pro-driver feature offered by Rapido is the implementation of waiting charges. A common complaint among drivers is that customers often keep them waiting even after they arrive at the designated pickup location.

Clearly communicating the waiting charges and showing a countdown timer ensures that the customers do not keep the driver waiting for long.

As Rapido continues to grow and adapt, it stands as a testament to the power of strategic differentiation and customer-centric innovation in achieving success even in a hyper-competitive market.